The Launchpad Quote System

Better

Technology

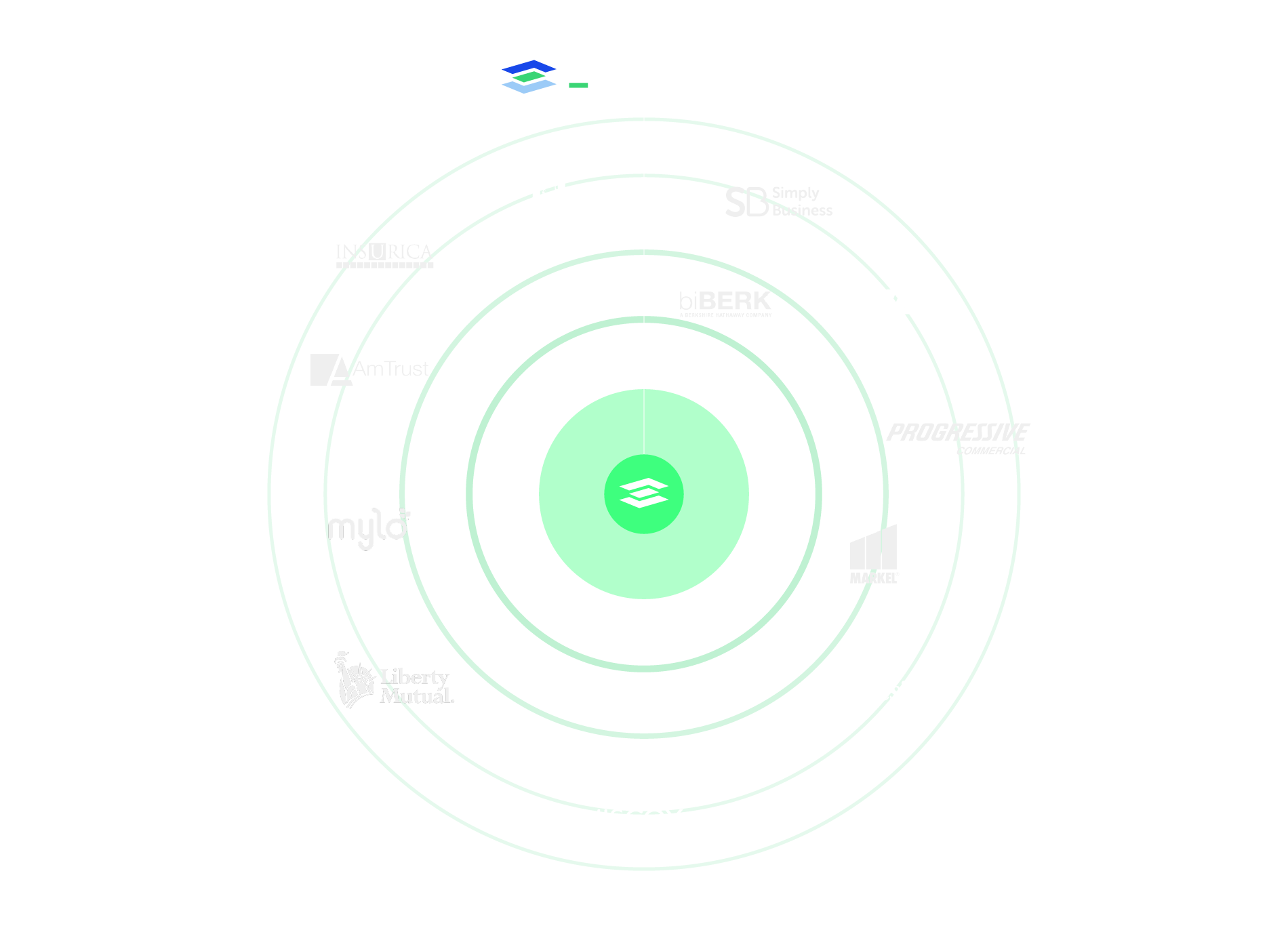

321 LaunchPad is changing how businesses discover and qualify insurers, connecting thousands of businesses to one of hundreds of agents & carriers

Better

Process

Our entire business was built to save time and reduce uncertainty in the commercial insurance application process

Better

Coverage

Our commercial insurance specialists educate customers on coverage options that are a proven fit for the business

Something many businesses don't know is that commercial insurance carriers have preferences for which types of businesses they insure.

The problem for most business owners is that they don't know which carrier is the best fit for their business, leading to high premiums or declined applications for coverage .

The 321 LaunchPad is connected to the largest network of commercial insurers available anywhere. We match your business with a qualified insurer so you get the right coverage for a fair price.